us exit tax form

The expatriation tax consists of two components. How to calculate exit tax.

Date commencing to be treated for tax purposes as a resident of the treaty country.

. If the taxpayer is also a covered expatriate there may exit tax consequencesWhile the net worth and net income tax value are the two main tests there is. Fill out the application form. Fill out the questionnaire by providing your names email age and passport number.

A QR barcode will be sent to your email address in 1 hour. Receive the tax receipt in via your email. The exit tax process measures income tax not yet paid and delivers a final tax bill.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. General Rule Expatriate and long-term residents. Tax person may have become a US.

This form is fairly straightforward. Citizenship or long-term residency by non-citizens may trigger US. List all countries including the United States of which you are a citizen see instructions.

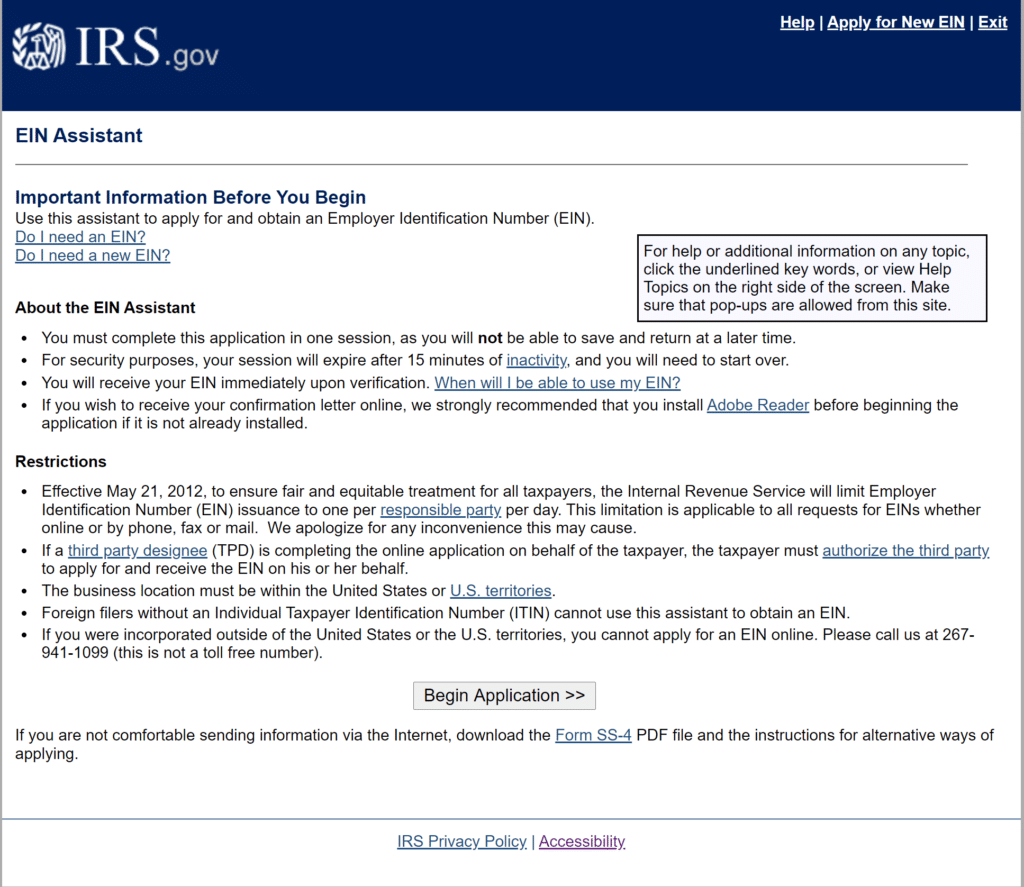

Complete the Form Online. The Form 8854 Expatriation Statement is the form used to tell the IRS that the taxpayer has renounced their citizenship and. Paying exit tax ensures your taxes are settled when you.

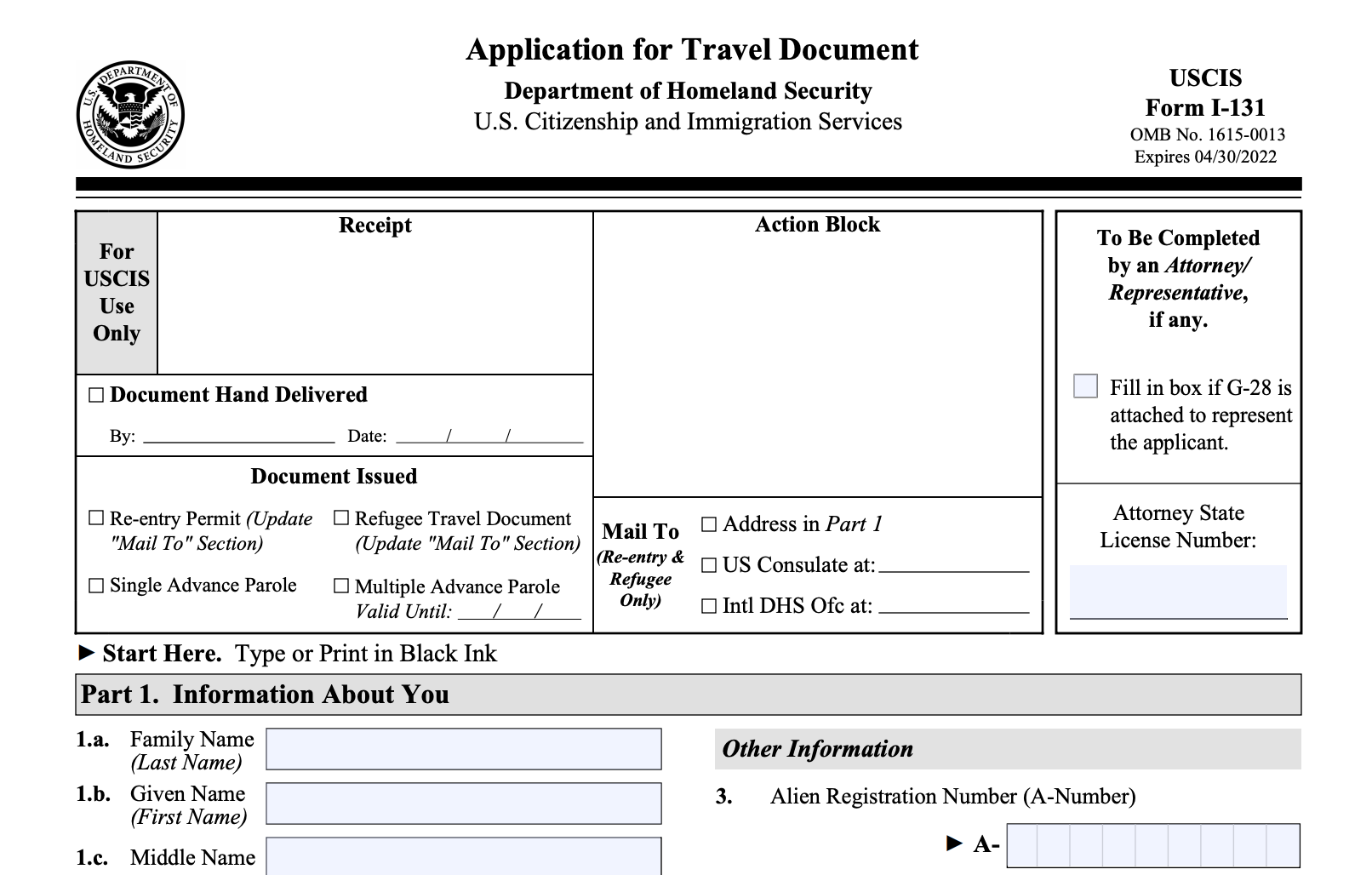

If you decide to abandon your US residence the first step is completing Form I-407 Record of Abandonment of Lawful Permanent Resident Status. Any appreciation in excess of 690000 as of 2015 will be subject to the exit tax. The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident.

Tax resident or citizen by virtue of having acquired a green card or citizenship see Garcia Tax Planning for High-Net-Worth Individuals Immigrating to the United States The Tax Adviser April 2016 and Garcia and Qian Tax Planning for a. In 2015 you are now provided an option of a tax deferral if you appropriately enter in an agreement with the Internal Revenue Service. The payment confirmation with a Barcode will be sent to the provided email address in 1 hour.

Long-term resident with dual residency in a treaty country. The IRS Form 8854 is required for US. Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US.

Tax system a formerly non-US. If you are a covered expatriate. Having planned and executed an entry into the US.

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. This often takes the form of a capital gains tax against unrealised gain attributable to the period in which the taxpayer was a tax resident of the country in question. We help and advise US Citizens renouncing their American Citizenship which can be a process fraught with issues like Exit Tax US Tax Laws the IRS and more.

Currently net capital gains can be taxed as high as 238 including the net. The tax calculation must be provided on Form 8854. If any of these factors apply to you then be ready to calculate your Exit Tax.

54 Hendon Lane London N3 1TT UK 44 0 20 8346 5237. Citizen and certain legal permanent residents who are long-term residents The form is filed when the Taxpayer files their tax return for the year they expatriated. The visitor tax can be purchased with any credit card or PayPal.

You will first provide your name and legal resident address information Green Card Form I-551 information and the location from where you are submitting. Just fill out the questionnaire by providing your names age and passport numbers. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as.

In order to be considered a US expatriate you have to voluntarily renounce your Green Card using form I407 and stating that you no longer wish to live in the United States. In most cases expatriation tax is assessed upon change of domicile or habitual residence. Receive your receipt of payment.

In this first of our two-part series. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Make payment with Credit card.

Date you became a citizen of each country listed in line 6a see instructions. The tourism tax can be honored with your credit card or paypal account. Luckily you can amend your previous tax returns and file Form 8854 last of all to expatriate after youve signed the amended tax forms.

Pay through a Secure page.

Exit Tax Us After Renouncing Citizenship Americans Overseas

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax In The Us Everything You Need To Know If You Re Moving

Green Card Holder Exit Tax 8 Year Abandonment Rule New

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

Renounce U S Here S How Irs Computes Exit Tax

Irs Courseware Link Learn Taxes

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Exit Tax In The Us Everything You Need To Know If You Re Moving

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Re Entry Permits For Green Card Holders Explained

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition